Investing in real estate can be a lucrative path to building wealth, but it requires careful planning and a solid understanding of the market. Whether you’re a seasoned investor or just starting, this guide will provide you with valuable insights to help you navigate the world of real estate investment.

Understanding the Market

Before diving in, it’s crucial to research the local real estate market. Analyze property values, rental rates, and market trends. Consider factors like population growth, economic conditions, and infrastructure development. Understanding these factors will help you identify promising areas for investment.

Finding the Right Property

Finding the right property is key to a successful investment. Consider factors such as location, property type (single-family home, multi-family unit, commercial property), and potential rental income. Working with a real estate agent who specializes in investment properties can be beneficial. They can help you find properties that meet your investment goals and navigate the complexities of the buying process. Learn more about finding the right property.

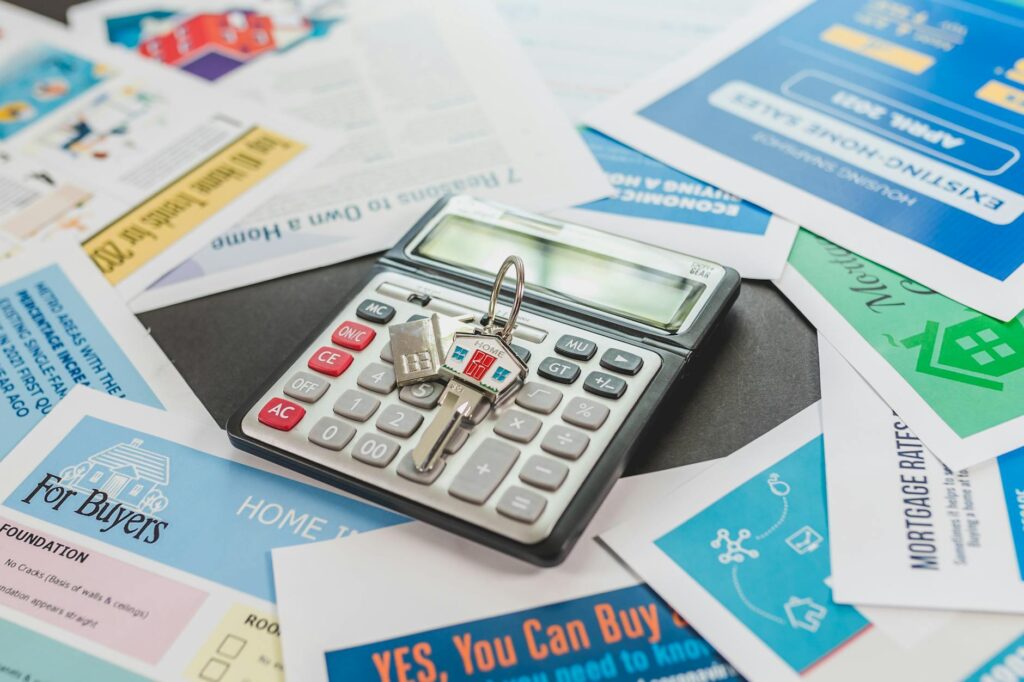

Financing Your Investment

Securing financing is often a critical step. Explore various financing options, such as conventional loans, FHA loans, or private money lenders. Understand the terms and conditions of each loan, including interest rates, down payments, and closing costs. Proper financial planning is essential, as you may need to secure multiple loans for your real estate portfolio. Check out this resource on real estate financing.

Managing Your Investment

Managing your investment involves more than just collecting rent. It includes handling tenant relations, property maintenance, and handling repairs. Consider hiring a property management company, especially if you’re a first-time investor or own multiple properties. Regular inspections and timely maintenance can prevent costly repairs down the line. Read our guide on effective property management.

Analyzing Your ROI

Regularly analyzing your return on investment (ROI) is essential to track your progress and make informed decisions. Consider factors such as rental income, expenses (mortgage payments, property taxes, insurance, maintenance), and potential appreciation in property value. Understanding your ROI will help you determine the profitability of your investment and identify areas for improvement. Use this ROI calculator to help you analyze your investment.

Diversifying Your Portfolio

Diversifying your portfolio is a smart strategy to mitigate risk. Instead of putting all your eggs in one basket, spread your investment across different properties and locations. This approach helps to balance potential losses and maximize your overall return. [IMAGE_3_HERE] Consider diversifying into different property types as well, such as residential, commercial, or even REITs. Discover different real estate investment strategies.

Real estate investing can be a rewarding endeavor, but it’s essential to approach it strategically and with a long-term perspective. By carefully researching the market, selecting suitable properties, and effectively managing your investments, you can build a profitable and sustainable real estate portfolio. Remember to seek professional advice when necessary, particularly from financial advisors and real estate professionals. Consult a financial professional for advice tailored to your situation.

Frequently Asked Questions

What are the initial costs involved in real estate investment? The initial costs can vary greatly depending on the property price, location, and financing options. Expect costs associated with the down payment, closing costs, and any necessary renovations or repairs.

How can I mitigate the risks associated with real estate investment? Risk mitigation involves thorough due diligence, careful property selection, diversification of your portfolio, and securing adequate insurance coverage.

What are the tax implications of real estate investment? Tax implications are complex and vary depending on your circumstances. Consult with a tax professional to understand the tax implications specific to your investment strategy.

How do I find reliable tenants for my rental property? Thorough tenant screening is crucial. Use background checks, credit reports, and verify rental history to minimize the risk of problematic tenants. Learn more about effective tenant screening.

What are some common mistakes to avoid? Avoid overextending yourself financially, neglecting property maintenance, and failing to properly screen tenants.